It’s completely about you and your goals.

Comprehensive Financial Planning is nothing complicated. Its a financial checkup and scrutiny of all aspects of your financial state including your cash flux analysis, planned retirement, tax planning, risk management and wealth management. We make sure to guard and achieve all your financial needs like kids education, marriage, vacation, and also re-structuring of loans and tax optimisation.

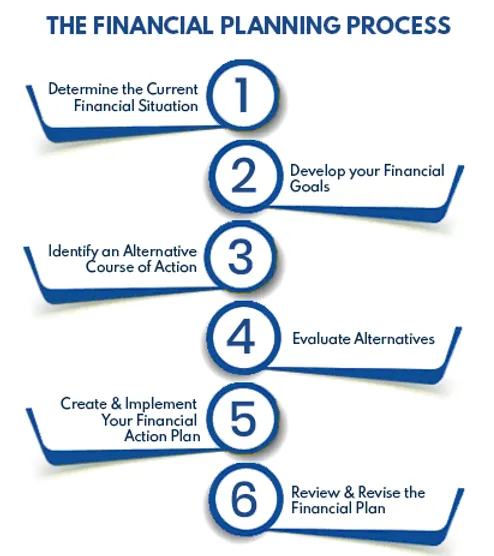

Only with overall examination and thorough understanding of your current financial situations we begin with our Comprehensive financial planning process. We don’t leave your hands once planning is done. Our financial planning process is dynamic in nature. As soon as the implementation part is done, we make sure to be in touch on regular basis so that we can rebalance or fine-tune the portfolio as and when necessary. This is essential because we believe change is inevitable and we only focus to deliver steady counsel, unbiased service, and most importantly a level of dedication that makes your goals our own.

❝Money Is 80% behaviour, 20% head knowledge. It’s what you do, not what you know❞

5 Steps Comprehensive Financial Planning Process

Client Profiling

We try to know your current financial status, assets, liabilities, goals and most importantly YOU.

Risk Profiling

The key step in planning for your various life stage goal is to understand your Risk Profile. Risk profile includes two important parts – risk appetite and risk tolerance. Risk appetite tells us how much risk you are willing to take, whereas risk tolerance tells how much risk your finances can handle. Asset Allocation and Time horizon to reach your goals is determined by it.

Number Crunching

It is now the job of our Financial expert in bringing a numerical perspective to the given financial situation. Here is the time when you can ask questions based on the strategy or product suggested as it relates to output for achieving your goals.

Presenting the Plan

is the actual advice drafted in a plan format for you. We draft a comprehensive financial plan for you after our number crunching session’s agreed figures.

Execution

in the process is the major step that is implementing the plan. We help you in opening up a platform, obtaining the recommended products and in pursuing the plan identified in step four