Why Invest In Mutual Funds?

Let’s glance at why should one consider investing in mutual funds over other options to achieve their financial goals:

Professional Managers

Mutual funds are managed by professional people who have years of experience handling different types of assets. They are a group of dedicated team that handles all financial decisions based on the performance & prospects available in the market.

Offers Convenience

If saving time & convenience is what you seek then mutual funds are an ideal choice for investment. Because of low investment amount options, multiple choices based on one’s life & financial goals, offering the ability to redeem them on any business day, mutual funds are much sought after.

Diversification

Mutual funds help counter risks to a large extent by equally distributing your investments across diverse range of asset classes. Mutual funds work by the adage “Do Not Put All Your Eggs in One Basket”.

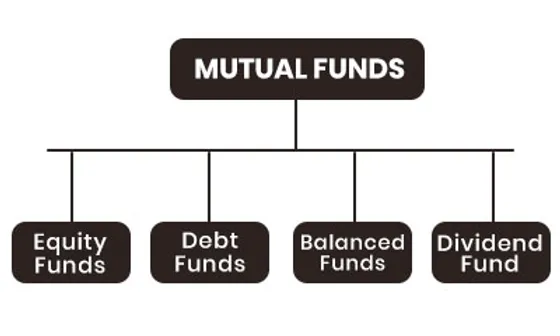

Types Of Mutual Funds

Equity Funds

These are type of funds that primarily invest in stocks and main investment objective of this class of funds is long term capital growth. Further, there are many types of equity funds which are categorized based on the size of the companies like large, medium or small.

Debt Funds

These funds are known as safe investments and provide fixed returns. In these, funds are invested in debt instruments like company bonds, government bonds, fixed income assets.

Balanced Funds

The strategy used by these funds are to maintain a certain percentage of mix of both fixed income & equities. Normally, a typical balanced fund will maintain a distribution of 60% equity & 40% fixed income. A similar type of fund known as “Asset Allocation Fund” follows on similar objectives that of Balanced Funds but then these kinds of funds do not hold any specified percentage of any asset class.

Dividend Funds

This type of mutual fund invests in the stock of companies that pay dividends, which are profits that a company shares with its stakeholders. These are income-generating funds & tend to be less risky than other types of funds. It is a good choice of investment for those who seek regular payments over appreciation.

How to Invest?

Direct Investment

Visit the nearest branch of the fund house to collect an application form or download it from the web. You must go through the fine print carefully and clear all your doubts before investing.

Agents

These are sales professionals who reach out to potential customers and inform them about the various fund options. You can choose a fund based on your income, investment goal, and risk appetite. The agent helps you with the application process, transactions, redemption, and cancellation. They charge a commission for their services.

Online (Distributors/Fund Houses)

Buying/selling MF units online is common today. This helps in saving time and efforts, and most importantly, makes it easier to compare various funds to make an informed decision. ClearTax is one such portal that handpicks the best Mutual Funds from the country’s top fund houses for you, absolutely free of cost. All you need to do is enter your personal details and make the payment. The entire process can be done in less than five minutes.